Last Updated: January, 2026

What Are the 2026 Social Security Disability Payment Amounts?

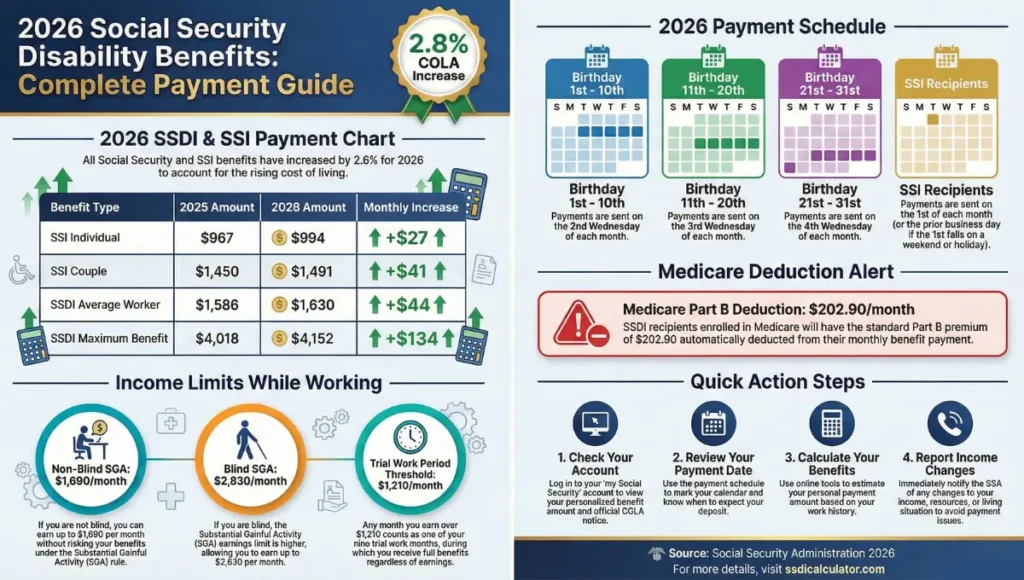

In 2026, Social Security disability benefits increased by 2.8%. SSI recipients now get up to $994 monthly. SSDI payments average $1,630 for disabled workers.

The raises started December 31, 2025 for SSI and January 2026 for SSDI. Learn more about the 2026 SSDI COLA increase and how it affects your payments.

Quick Summary:

- SSI maximum benefit is now $994 per month (individual)

- SSDI average payment is $1,630 for disabled workers

- 2.8% Cost-of-Living Adjustment (COLA) applies to all recipients

- New income limits help you work while keeping benefits

- Payment dates depend on your birthday

- Medicare Part B premiums increased to $202.90 monthly

2026 Official Disability Pay Chart

The Social Security Administration raised all disability payments by 2.8% for 2026.

Here’s what recipients will receive:

| Benefit Type | 2025 Amount | 2026 Amount | Monthly Increase |

|---|---|---|---|

| SSI Individual | $967 | $994 | +$27 |

| SSI Couple | $1,450 | $1,491 | +$41 |

| SSI Essential Person | $484 | $498 | +$14 |

| SSDI Average (Disabled Worker) | $1,586 | $1,630 | +$44 |

| SSDI Average (Worker + Family) | $2,857 | $2,937 | +$80 |

| SSDI Maximum (at Full Retirement Age) | $4,018 | $4,152 | +$134 |

Source: Social Security Administration 2026 COLA Fact Sheet

Understanding Your Benefit Type

SSI (Supplemental Security Income):

- For low-income people with disabilities

- No work history required

- Asset limits apply ($2,000 individual, $3,000 couple)

SSDI (Social Security Disability Insurance):

- Based on your work history

- Must have earned enough work credits

- Payment amount varies by past earnings

Confused about which program you qualify for? Read our guide explaining the differences between SSI and SSDI to understand which benefit is right for you. Use our SSDI benefits calculator to estimate your monthly payment based on your work history.

2026 Income Limits While Working

You can work part-time and keep disability benefits. Stay under these monthly limits:

Substantial Gainful Activity (SGA)

Non-Blind Recipients: $1,690 per month (up from $1,620 in 2025)

Blind Recipients: $2,830 per month (up from $2,700 in 2025)

If you earn above these amounts, SSA may consider you able to work. This could end your disability benefits.

Trial Work Period (TWP)

You get nine trial work months. Any month you earn over $1,210 counts as one trial month. During this period, you keep full benefits regardless of earnings.

SSI Student Income Exclusion

Students under age 22 can exclude:

- Up to $2,410 per month

- Annual limit of $9,730

This helps students work without losing SSI benefits.

Source: SSA What’s New in 2026

2026 Resource and Asset Limits

SSI Resource Limits (Unchanged)

- Individual: $2,000 maximum

- Couple: $3,000 maximum

Resources include:

- Bank accounts

- Stocks and bonds

- Extra vehicles

- Property (excluding primary home)

Work Credits for SSDI

You earn one work credit for every $1,890 in wages in 2026. Maximum four credits per year ($7,560 total earnings).

Most people need 40 credits to qualify for SSDI. Younger workers may need fewer credits. Check how many work credits you’ve earned to see if you qualify.

Important Deductions from Your Check

Medicare Part B Premium

The 2026 Medicare Part B premium is $202.90 per month. This increased from $185 in 2025.

SSDI recipients enrolled in Medicare have this amount deducted automatically. This may reduce your actual COLA increase.

Example:

- Your SSDI raised by $44

- Medicare premium raised by $17.90

- Net increase: only $26.10

SSI recipients usually qualify for Medicaid instead. They typically don’t pay Medicare premiums.

Complete 2026 Payment Schedule

Your payment date depends on your birthday or benefit type.

Standard Payment Rules

Birthday 1st – 10th: Second Wednesday of each month

Birthday 11th – 20th: Third Wednesday of each month

Birthday 21st – 31st: Fourth Wednesday of each month

SSI Recipients: Usually the 1st of the month (or prior business day if weekend/holiday)

Pre-May 1997 Beneficiaries: Typically the 3rd of each month

View the complete SSDI payment schedule 2026 with deposit dates for your specific benefit type.

Full 2026 Payment Calendar

| Month | SSI Payment | Pre-May 1997 | Birth 1–10 | Birth 11–20 | Birth 21–31 |

|---|---|---|---|---|---|

| January | Dec 31, 2025* | Jan 2** | Jan 14 | Jan 21 | Jan 28 |

| February | Jan 30* | Feb 3 | Feb 11 | Feb 18 | Feb 25 |

| March | Feb 27* | Mar 3 | Mar 11 | Mar 18 | Mar 25 |

| April | Apr 1 | Apr 3 | Apr 8 | Apr 15 | Apr 22 |

| May | May 1 | May 1*** | May 13 | May 20 | May 27 |

| June | Jun 1 | Jun 3 | Jun 10 | Jun 17 | Jun 24 |

| July | Jul 1 | Jul 2** | Jul 8 | Jul 15 | Jul 22 |

| August | Jul 31* | Aug 3 | Aug 12 | Aug 19 | Aug 26 |

| September | Sep 1 | Sep 3 | Sep 9 | Sep 16 | Sep 23 |

| October | Oct 1 | Oct 2** | Oct 14 | Oct 21 | Oct 28 |

| November | Oct 30* | Nov 3 | Nov 10**** | Nov 18 | Nov 25 |

| December | Dec 1 | Dec 3 | Dec 9 | Dec 16 | Dec 23 |

Notes:

- *Early payment due to weekend or holiday

- **Adjusted for weekend

- ***May 3 is Sunday; paid May 1

- ****Veterans Day (Nov 11); moved to Nov 10

Important Calendar Notes

Double SSI Payments in 2026: You’ll receive two SSI payments in January, July, October, and December. The second payment covers the next month.

No SSI Payments in: March, August, and November 2026 (already paid early in prior month).

Source: SSA 2026 Payment Schedule (PDF)

How to Check Your Exact Benefit Amount

Log into your my Social Security account at www.ssa.gov/myaccount to:

- View your personalized 2026 benefit amount

- See your official COLA notice

- Check payment dates

- Update direct deposit information

- Request benefit verification letters

Don’t have an account? Create one using your email, Social Security number, and ID verification.

Who Qualifies for Disability Benefits?

SSI Eligibility

You must:

- Have a qualifying disability or be age 65+

- Have limited income and resources

- Be a U.S. citizen or qualified non-citizen

- Live in the U.S. or Northern Mariana Islands

SSDI Eligibility

You must:

- Have a qualifying medical condition lasting 12+ months

- Have earned enough work credits

- Be unable to perform substantial gainful activity

- Meet SSA’s definition of disability

Most adults need 20 work credits earned in the last 10 years. Younger workers may qualify with fewer credits.

Not sure if you qualify? Use our SSDI eligibility checker to see if you meet the requirements. You can also review the complete list of qualifying conditions for disability benefits.

Frequently Asked Questions (FAQs)

Q: How much is the SSI payment in 2026?

The maximum SSI payment is $994 per month for individuals and $1,491 for couples. Actual amounts may be lower based on other income or living arrangements.

Q: When will I receive my 2026 COLA increase?

SSI recipients received the increase on December 31, 2025. SSDI recipients got the raise starting January 2026. Your payment date depends on your birthday.

Q: Can I work while receiving disability benefits?

Yes. Stay under $1,690 monthly ($2,830 if blind) to keep benefits. SSA offers work incentives like the Trial Work Period to help you return to work safely.

Q: Why is my COLA increase smaller than expected?

Medicare Part B premiums rose to $202.90 in 2026. This deduction happens automatically for SSDI recipients, reducing your net increase. SSI recipients usually don’t pay this premium. Note that SSDI benefits may be taxable depending on your total household income.

Q: What are the SSI resource limits for 2026?

$2,000 for individuals and $3,000 for couples. These limits did not change from 2025. Your home and one vehicle typically don’t count toward this limit.

Q: How do I apply for disability benefits?

Apply online at www.ssa.gov/apply, call 1-800-772-1213, or visit your local Social Security office. Gather medical records, work history, and personal documents before starting. Our step-by-step guide on how to apply for SSDI walks you through the entire application process.

Next Steps

Check Your Benefit: Log into my Social Security to see your exact 2026 amount.

Calculate Your Payment: Use our SSDI payment calculator to estimate your monthly benefit amount.

Estimate Back Pay: If you’re awaiting approval, try our SSDI back pay calculator to see potential retroactive benefits.

Report Changes: Notify SSA immediately if your income, resources, or living situation changes.

Plan for Deductions: Remember Medicare premiums may reduce your actual increase.

Save Important Dates: Mark your payment dates on your calendar to track deposits.

For questions, call the SSA at 1-800-772-1213 (TTY 1-800-325-0778), Monday–Friday, 8 AM–7 PM local time.

Official Sources: